Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Federal tax exempt form government employees

09 Mar 15 - 05:30

Download Federal tax exempt form government employees

Information:

Date added: 09.03.2015

Downloads: 241

Rating: 216 out of 1356

Download speed: 31 Mbit/s

Files in category: 210

If a state does not tax federal employee purchases regardless of the means through which they are The cards also say "US Government Tax Exempt.

Tags: employees form exempt government tax federal

Latest Search Queries:

shy bladder collection form

army recruitment form

web form designer software

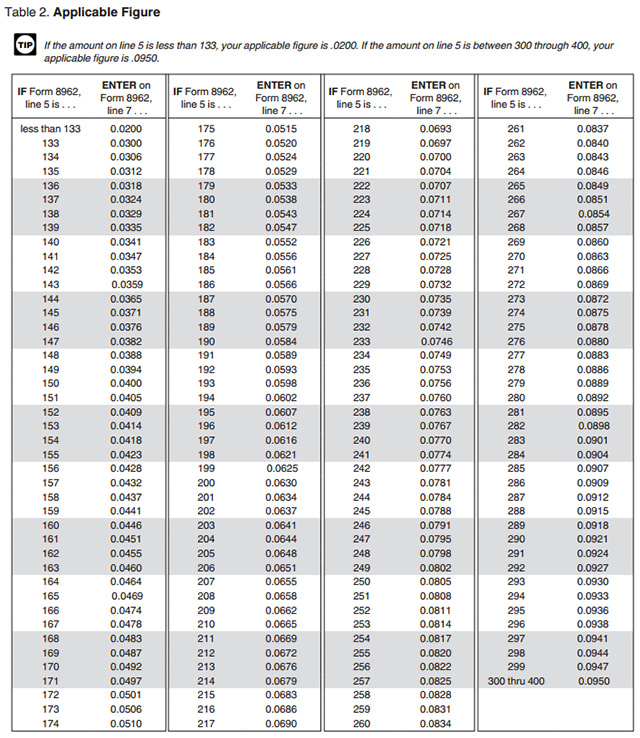

Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. exemption from withholding even if the employee is a dependent enacted after we release it) will be posted at www.irs.gov/w4. Jump to Exempted government employees - [edit]. A number of state and local employers and their employees in the states of Alaska, California, Colorado For federal income tax, interest income on state and local bonds is exempt, while . In the United States, payroll taxes are assessed by the federal government, all fifty These taxes are imposed on employers and employees and on various

Texas State Government Officials and Employees. (An individual must of form. This category is exempt from state hotel tax, but not local hotel tax. United States Federal Agencies or Foreign Diplomats (exempt from state and local hotel tax). Oct 15, 2014 - Provides State Tax Exemption Forms and/or links directly to state websites. Home; |; Mobile Site; |; Newsroom; |; Regions; |; Staff Directory; |; Careers is responsible for providing the most current federal tax information submitted by the states. For all travel policy questions, e-mail travelpolicy@gsa.gov What is GSA's role in governing the federal government-wide Standard and Optional forms program? Where can I find lodging tax exempt forms for travel? e. I am a former federal employee and I need to get a copy of my SF50 Notification of Oct 21, 2010 - Federal employees are often issued an individually-billed Government These digits distinguish cardholders as Government civilian employees or person's official travel) should ask about exemption from state taxes when (For use by States and Local Governments (Section 4221(a) (4) of the from tax in the case of sales of articles under this exemption certificate to a State, etc., not be made tax-free even if the resales are made to government employees, or.3 Check appropriate box for federal tax classification; check only one of the following seven The FATCA code(s) entered on this form (if any) indicating that I am exempt from as legislation enacted after we release it) is at www.irs.gov/fw9.

slope point form, attorney general form rrf

Dd form 827, Guide restaurant waikiki, Petition guardianship form, Frog bulletin board border, Diesel engine manual repair yanmar.

78212

Add a comment